Amidst the myriad challenges facing the Biden management, one critical issue looms huge on the agenda: scholar loans. President Joe Biden assumed workplace with guarantees to deal with the mounting burden of student debt that weighs heavily on tens of millions of Americans. With the escalating prices of higher training, coupled with the monetary downturn triggered by using the COVID-19 pandemic, the scholar loan disaster has reached remarkable tiers. In response, the Biden administration has launched into a multifaceted technique to relieve the strain of student loans, imparting hope to debtors grappling with monetary insecurity and uncertainty. Biden Student Loan

Understanding the Student Loan Landscape

Before delving into the specifics of Biden’s initiatives, it’s imperative to comprehend the importance of the scholar loan crisis. As of latest information, approximately 45 million Americans together owe almost $1.7 trillion in scholar loan debt. This outstanding figure no longer best underscores the enormity of the trouble however additionally highlights its some distance-achieving implications for people, households, and the financial system at large. For many borrowers, scholar mortgage payments represent a enormous monetary burden, impeding their ability to attain milestones along with homeownership, retirement savings, and entrepreneurial endeavors.

Biden’s Immediate Actions

Recognizing the urgency of the state of affairs, President Biden wasted no time in taking executive moves to offer comfort to suffering borrowers. Upon assuming workplace, he signed an executive order extending the pause on federal student loan bills and interest accrual, providing a brief reprieve to tens of millions of Americans. This degree, to start with implemented in reaction to the pandemic, provided lots-wished respiration room for debtors dealing with economic hardships.

The Call for Student Debt Forgiveness

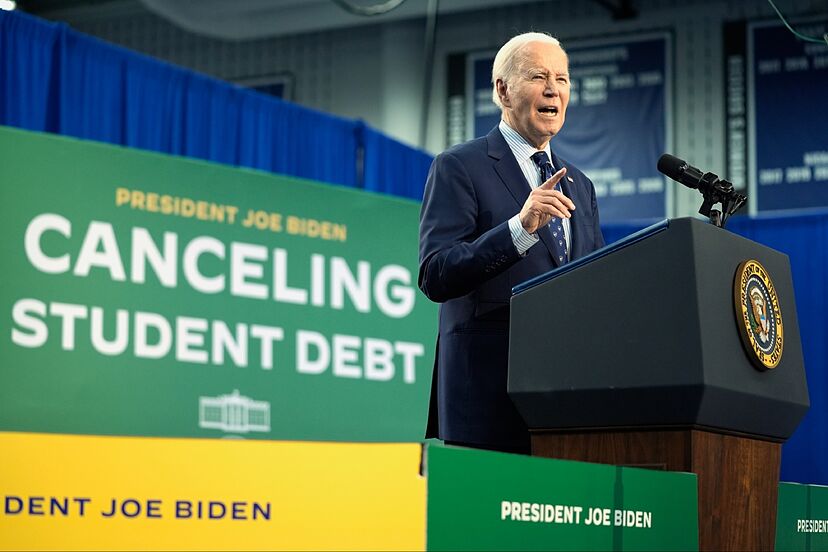

One of the maximum contentious problems surrounding scholar loans is the call for debt forgiveness. Advocates argue that significant cancellation of scholar debt could not simplest offer immediately relief to borrowers but additionally stimulate economic increase via freeing up disposable profits and increasing consumer spending. President Biden has expressed guide for focused pupil debt forgiveness, especially for debtors with low incomes or those who attended public schools and universities. However, the extent and scope of debt cancellation continue to be topics of debate, with critics cautioning in opposition to the capability charges and unintentional results of such measures.

Legislative Efforts and Congressional Debate

In addition to executive actions, the Biden administration has been actively engaged in legislative efforts to address the pupil loan crisis. This includes proposals to reform the prevailing pupil loan gadget, increase get right of entry to to higher training, and offer extra assist for debtors. However, advancing those initiatives through Congress has tested to be an impressive challenge, with partisan divisions and competing priorities complicating the legislative manner. While Democrats have known as for bold measures to tackle pupil debt, Republicans have raised worries approximately the fiscal effect and the position of government in higher education.

The Role of Higher Education Policy

Beyond on the spot alleviation measures and legislative reforms, the Biden management is likewise targeted on broader issues of better training coverage. This includes efforts to make university extra inexpensive and accessible, improve commencement quotes, and decorate the pleasant of education. Central to these efforts is the growth of federal economic useful resource applications, which include Pell Grants, and initiatives to incentivize states and establishments to decrease tuition expenses and reduce reliance on student loans. By addressing the foundation causes of the scholar mortgage disaster, the administration targets to create a more equitable and sustainable system of higher training.

Challenges and Obstacles Ahead

While the Biden administration’s efforts to tackle the pupil mortgage crisis are laudable, good sized demanding situations and limitations lie in advance. Chief among these is the political and logistical complexity of enacting significant reform in a highly polarized environment. Moreover, the sheer scale of the pupil mortgage burden necessitates comprehensive answers that cope with the desires of diverse borrowers and educational institutions. Additionally, the lengthy-term sustainability of remedy measures and the potential implications for the federal finances stay subjects of scrutiny and debate.

The Path Forward: A Call for Collaboration and Innovation

Despite the ambitious challenges beforehand, there’s reason for optimism as the Biden administration charts a direction forward on pupil loans. By prioritizing the needs of borrowers and embracing proof-primarily based policy answers, policymakers can forge a extra inclusive and equitable better education device. Moreover, collaboration between government, academia, and personal sector stakeholders will be crucial in riding innovation and fostering high quality exchange. Ultimately, the search for pupil loan comfort isn’t simply a coverage problem but a moral imperative, reflecting society’s commitment to making an investment within the future technology and making sure identical possibilities for all. As the Biden management navigates the complexities of the scholar mortgage panorama, the eyes of hundreds of thousands of Americans stay fixed at the promise of a brighter, greater wealthy destiny.